Comparing profitable and unprofitable Fintech is surprising

- Nov 19, 2024

- 1 min read

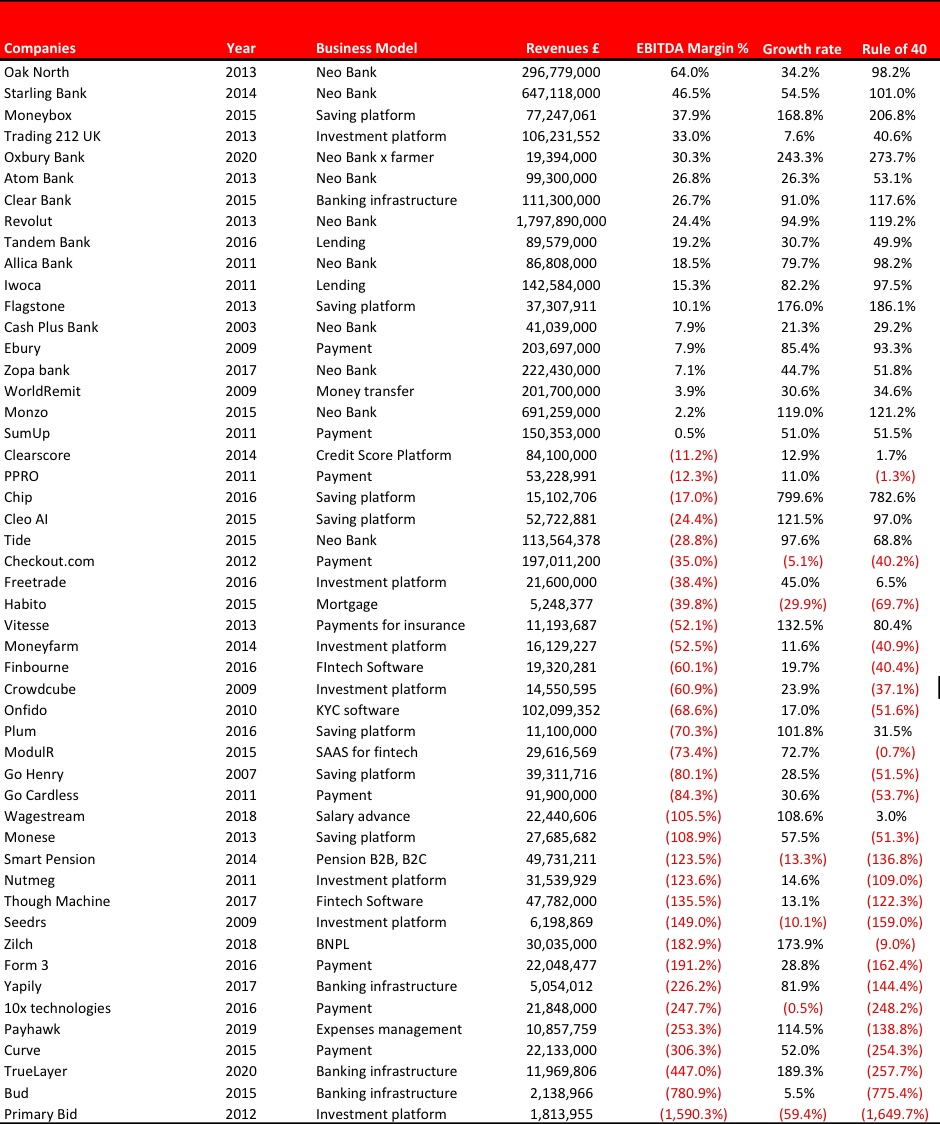

I closely monitor the performances of 50 private fintech companies. In this article, I compare the performance of the profitable and unprofitable companies, and some of the findings are surprising. Below is the data and our key observations.

Profitable companies are larger. On median, profitable companies did £111m of revenue in 2023 versus $22mm for unprofitable companies. That’s a >400% difference which is very material. It does make sense that larger companies would be more likely to be profitable as they theoretically enjoy greater economies of scale.

The profitability is high. The median operating margin for profitable companies in 2023 was 19%, whereas unprofitable companies had a margin of -83%. That is a surprisingly wide spread, and frankly while the unprofitable companies are arguably too unprofitable, the profitable companies are not giving up growth at the expenses of margin (see below).

The premium of profitability the profitable companies had median growth rate of 67% in 2023, which is pretty good, while the unprofitable companies grew at just 29% on median (that’s over 2x difference!).

The unprofitable companies in the panel seems in trouble because the cash losses don’t seem justifiable by an excellent growth rate.

Comments